The German Biotechnology Sector 2016

-

<ic:message key='Bild vergrößern' />

<ic:message key='Bild vergrößern' />

- The German Biotechnology Sector 2016

More revenue, more jobs, more financing, more R&D expenditure – all the signs are pointing towards a sustainable growth. In addition, German companies are increasingly attracing the interest of international capital.

Financing in the public and private sector

The financial situation mirrors a sustainable growth trend that has been observed since 2011: in 2015, around €550m was invested in German biotech companies which means an increase of 37% compared to the previous year (2014: €401m).

Both the private and the public companies have gained – they increased the amount of money raised by 52% and 61% respectively, although failing to reach the high levels of 2010 (see figure above). One IPO at Curetis AG took place on Euronext in Amsterdam (2014: 3).

Hot topics induce investments

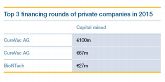

A closer look at the largest financing rounds (see on the left), whether in the private or public sector, reveals that German companies benefited most if they were active in immuno-oncology, cell therapy or Bio-IT. This also resulted in increased interest from foreign investors. As a result, the proportion of US investors was substantially enlarged in almost all capital increases in public companies. Foreign investors participated in about one third of the 20 private financing rounds, demonstrating that German companies are able to attract high levels of interest. Most of the rounds so far, however, have remained at a comparably low level, with less than €10m involved, so it remains to be seen whether the investors will be willing to put in further capital in the long run.

The top financing of 2015 was the multimillion investment by the Bill and Melinda Gates foundation into Tübingen-based RNA specialist CureVac.

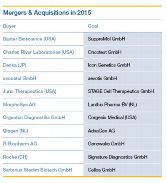

It demonstrated an accolade for German biotech expertise and drew huge attention to the local scene. Some major licensing deals, such as SuppreMol with Baxter and BioNTech with Eli Lilly and Sanofi, further support the theory that German firms are quite attractive from an international point of view.

The growing attractiveness of German technology platforms also was also underlined by several mergers and acquisitions. Five out of 11 buyers came from abroad, four others were German-German transactions for further consolidations of the sector – yet another sign of increased maturity that has been achieved in recent years.