The German Biotechnology Sector 2016

-

<ic:message key='Bild vergrößern' />

<ic:message key='Bild vergrößern' />

- The German Biotechnology Sector 2016

More revenue, more jobs, more financing, more R&D expenditure – all the signs are pointing towards a sustainable growth. In addition, German companies are increasingly attracing the interest of international capital.

Strength in medical biotechnology

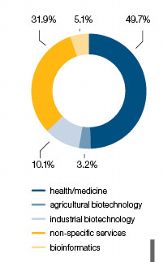

Observers of the German biotech sector will have noted a pretty unchanged picture of the sector when it comes to focal areas: the key task of most biotech companies is developing drugs or new diagnostic methods.

295 companies (49.7 %) belong to the field of ‘red’ biotechnology – a proportion that has remained steady for many years but which showed an increase in turnover of almost 10% (€2bn) and an augmention in R&D expenditure of 10.6% (€855m) in 2015.

German know-how in demand

A large majority of the companies (156) are either still in the preclinical stage of therapeutic research or developing technology platforms. Here 2015 demonstrated that German know-how is in greater demand than ever before, both from investors in Germany and also from abroad. This was particularly true for Göttingen-based Stage Cell Therapeutics GmbH which hit the headlines when it was bought for €52m by US-company Juno Therapeutics.

Another billionaire investment

Another success story that emerged in 2015 was Hamburg-based Immunservice GmbH. With their focus on Interleukin-2 as an approach not only to attacking cancerous diseases, but also to treating nicotine addiction and obesity, they convinced Michael Otto, another German billionaire, to invest in the German biotech company on a long-term basis. That local technologies are of high interest for the industry is also underlined by Munich-based Leukocare AG. Backed by the Swiss family-run office LifeCare Partners, the specialist for protein stabilisation and formulation has established more than 15 industrial partnerships in the medtech and pharma field. In the long term, the company particularly wants to increase its activities in the emerging field of drug-device-combinations. Several preclinical companies, such as Heidelberg-based Oryx, Adrenomed from Hennigsdorf or Freiburg-based Greenovation, further advanced their projects towards the next step of development in 2015, with the result that they are now counted as drug developers.

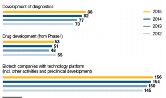

Growing relevance of diagnostics

A growing part of the biotech sector (85 firms) is dedicated to the development of diagnostics which reflects the increasing demand for early disease detection, e.g. in the field of infection diseases, and the relevance of accompanying diagnostics for therapeutic treatments, e.g. for a personalised medicine in the field of cancerous diseases. Some significant developments took place in 2015, resulting in the growth of a range of SMEs such as R-Biopharm, Altona Diagnostics and CeGaT. The power of German diagnostic technologies was also demonstrated in some M&A activities and financing. Swiss pharma company Roche acquired Signature Diagnostics from Potsdam to further expand its expertise in the cancer diagnostics field. Corporate financing arm Robert Bosch Venture Capital and medtech investors SHS, together with several German early-stage investors supported a €6m-round by GNA Biosolutions for advancing rapid clinical diagnostic instruments for the detection of multi-resistant strains.

Liquid biopsy in the focus

The development of liquid biopsy as a new tool for clinical diagnosis can be seen as a big step forward in the diagnostics field. A range of German companies, such as Sysmex Inostics, provide unique approaches in this emerging field which is beginning to completely change the way patients are characterised and treated, particularly with regard to indications where time is crucial.

Drug developer with full pipeline

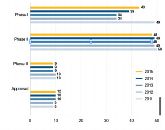

A total of 53 German biotech companies are fully dedicated to drugs and have one or more candidates in clinical development. Last year, a total of 100 biologically active compounds were in one of the three phases (2014: 97). For the second year in a row, there has been a gratifying increase in the first clinical phase: this time a total of 43 active substances were recorded in phase I (2014: 39). Thus, the downward trend of previous years has been halted.

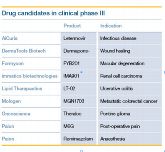

The majority of clinical candidates of German companies were in phase II in 2015, amounting to a total of 48 active substances (2014: 49). There was little change in the number phase III candidates (9 in total), most of them are still in ongoing trials. Only Formycon started phase III with its biosimilar FYB201 for the treatment of macular degeneration, while Octapharma’s blood clotting factor gained approval.

The establishment of a robust clinical pipeline is partly due to the high overall interest in immuno-oncology and cell therapies. Over the last ten years, many German companies succeeded in developing technologies or platforms that attracted big pharma or investors which are now resulting in new clinical projects.