The German Biotechnology Sector 2016

-

<ic:message key='Bild vergrößern' />

<ic:message key='Bild vergrößern' />

- The German Biotechnology Sector 2016

More revenue, more jobs, more financing, more R&D expenditure – all the signs are pointing towards a sustainable growth. In addition, German companies are increasingly attracing the interest of international capital.

The sector statistics in facts & figures

More revenue, more jobs, more financing, more R&D expenditure – all the signs are pointing towards a sustainable growth. In addition, German companies are increasingly attracing the interest of international capital.

The German biotech companies can look back on a favourable year. According to the company survey, which BIOCOM AG has now conducted annually via the information platform biotechnologie.de for more than ten years, the turnover of the German biotech sector again exceeded €3bn. Total figures increased by 8.3% to €3.28bn.

R&D expenditure above one billion

Another upswing has been observed regarding spending on research and development (R&D). For the first time since 2010, the innovation budget cracked the one billion euros mark (+8.8%) and now stands at €1.04bn (2014: €953m). Financial investments mirrored the growth trend in 2015: around €550m was invested in German biotech companies. Compared to €401m in the year before, this is a significant increase of 37%. A large proportion of the money (€260m) went into the private biotech sector, but the public companies also gained significant interest from investors in 2015, raising a total of €245m.

More employees than ever

With a total of 19,010 (2014: 17,930), there were more employees than ever before working in biotech companies that are occupied wholly or predominantly with modern biotechnological methods. The total number of these companies rose slightly to 593 (2014: 579). Thereby, the following figures and conclusions relate only to the ‘dedicated’ biotechnology companies, as defined by the OECD (see for methods).

Biotech as an industrial topic

There is sustained interest in biotechnological processes and services from big business. This is confirmed by a consistently high number of companies in which biotechnology represents only one aspect of business. In 2015, the category of ‘other biotechnology-active companies’ comprised a total of 133 companies (2014: 131). These included both pharmaceutical and chemical companies focused on innovative biotechnological processes as well as companies from the areas of environment, waste management, energy and agriculture. In 2015, a total of 20,250 people were employed in the biotechnology-oriented areas of such companies. Compared to the previous year (2014: 19,200), this represents a growth of 5.5%. Overall, there was an increase in total headcount in commercial biotechnology to 39,260 (2014: 37,130) (+5,7%).

Strength in medical biotechnology

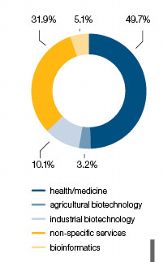

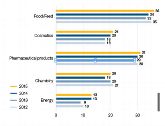

Observers of the German biotech sector will have noted a pretty unchanged picture of the sector when it comes to focal areas: the key task of most biotech companies is developing drugs or new diagnostic methods.

295 companies (49.7 %) belong to the field of ‘red’ biotechnology – a proportion that has remained steady for many years but which showed an increase in turnover of almost 10% (€2bn) and an augmention in R&D expenditure of 10.6% (€855m) in 2015.

German know-how in demand

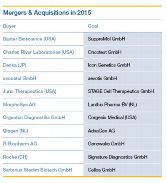

A large majority of the companies (156) are either still in the preclinical stage of therapeutic research or developing technology platforms. Here 2015 demonstrated that German know-how is in greater demand than ever before, both from investors in Germany and also from abroad. This was particularly true for Göttingen-based Stage Cell Therapeutics GmbH which hit the headlines when it was bought for €52m by US-company Juno Therapeutics.

Another billionaire investment

Another success story that emerged in 2015 was Hamburg-based Immunservice GmbH. With their focus on Interleukin-2 as an approach not only to attacking cancerous diseases, but also to treating nicotine addiction and obesity, they convinced Michael Otto, another German billionaire, to invest in the German biotech company on a long-term basis. That local technologies are of high interest for the industry is also underlined by Munich-based Leukocare AG. Backed by the Swiss family-run office LifeCare Partners, the specialist for protein stabilisation and formulation has established more than 15 industrial partnerships in the medtech and pharma field. In the long term, the company particularly wants to increase its activities in the emerging field of drug-device-combinations. Several preclinical companies, such as Heidelberg-based Oryx, Adrenomed from Hennigsdorf or Freiburg-based Greenovation, further advanced their projects towards the next step of development in 2015, with the result that they are now counted as drug developers.

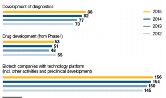

Growing relevance of diagnostics

A growing part of the biotech sector (85 firms) is dedicated to the development of diagnostics which reflects the increasing demand for early disease detection, e.g. in the field of infection diseases, and the relevance of accompanying diagnostics for therapeutic treatments, e.g. for a personalised medicine in the field of cancerous diseases. Some significant developments took place in 2015, resulting in the growth of a range of SMEs such as R-Biopharm, Altona Diagnostics and CeGaT. The power of German diagnostic technologies was also demonstrated in some M&A activities and financing. Swiss pharma company Roche acquired Signature Diagnostics from Potsdam to further expand its expertise in the cancer diagnostics field. Corporate financing arm Robert Bosch Venture Capital and medtech investors SHS, together with several German early-stage investors supported a €6m-round by GNA Biosolutions for advancing rapid clinical diagnostic instruments for the detection of multi-resistant strains.

Liquid biopsy in the focus

The development of liquid biopsy as a new tool for clinical diagnosis can be seen as a big step forward in the diagnostics field. A range of German companies, such as Sysmex Inostics, provide unique approaches in this emerging field which is beginning to completely change the way patients are characterised and treated, particularly with regard to indications where time is crucial.

Drug developer with full pipeline

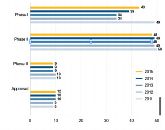

A total of 53 German biotech companies are fully dedicated to drugs and have one or more candidates in clinical development. Last year, a total of 100 biologically active compounds were in one of the three phases (2014: 97). For the second year in a row, there has been a gratifying increase in the first clinical phase: this time a total of 43 active substances were recorded in phase I (2014: 39). Thus, the downward trend of previous years has been halted.

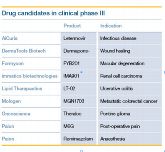

The majority of clinical candidates of German companies were in phase II in 2015, amounting to a total of 48 active substances (2014: 49). There was little change in the number phase III candidates (9 in total), most of them are still in ongoing trials. Only Formycon started phase III with its biosimilar FYB201 for the treatment of macular degeneration, while Octapharma’s blood clotting factor gained approval.

The establishment of a robust clinical pipeline is partly due to the high overall interest in immuno-oncology and cell therapies. Over the last ten years, many German companies succeeded in developing technologies or platforms that attracted big pharma or investors which are now resulting in new clinical projects.

Development in the service sector and bioeconomy

Apart from the health sector, the second largest pillar of the German biotech scene is companies (186) that are not active in a specific field. This includes all companies providing services exclusively or primarily for other biotech firms, or which function as suppliers.

In 2015, all these companies together had a turnover of €690m (+2%) and an R&D budget of €109m (+1.9%), demonstrating that the service business model has proven to be a guarantee for continuous growth within the German biotech sector since 2011 when turnover was €556m.

More turnover in bioeconomy

There are 60 companies developing industrial applications in various other sectors (see fig. 5) which demonstrates the relevance of biotech processes throughout the industry as a whole. This is also underlined by a rise of 14.3% in industrial biotechnology turnover. The application of biotechnology in the plant breeding and agricultural sector has decreased over the years, but in 2015 the 19 companies generated an increase of 5.8% in turnover (€32.3m). Thus, the growing interest in sustainable, biobased processes and products therefore acts as a slight boost for the industrial and agricultural biotech business in Germany.

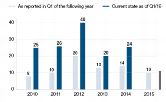

Employee development and new startups

With a total of ten start-ups (Q1/2014: 14) the founding dynamics in 2015 were at the same level as in previous years, at least from what can be seen now.

As shown in figure 6 on the left, there is an increase of total start-up numbers for the year and, from experience, an increase to more than 20 start-ups can also be expected for 2015. Most of the newcomers known today are active in the health area (8) and two in industrial biotech. Five insolvencies and five liquidations were reported in 2015.

Dynamic employment market

In terms of jobs, the German biotech sector is a dynamic employment market. In 2015, the 593 dedicated companies reported a total increase of more than 1,000 employees, with the largest increase in Baden-Württemberg (+240). Compared to previous years, in 2015 more middle-sized companies throughout the country employed more people.

Financing in the public and private sector

The financial situation mirrors a sustainable growth trend that has been observed since 2011: in 2015, around €550m was invested in German biotech companies which means an increase of 37% compared to the previous year (2014: €401m).

Both the private and the public companies have gained – they increased the amount of money raised by 52% and 61% respectively, although failing to reach the high levels of 2010 (see figure above). One IPO at Curetis AG took place on Euronext in Amsterdam (2014: 3).

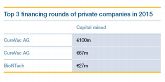

Hot topics induce investments

A closer look at the largest financing rounds (see on the left), whether in the private or public sector, reveals that German companies benefited most if they were active in immuno-oncology, cell therapy or Bio-IT. This also resulted in increased interest from foreign investors. As a result, the proportion of US investors was substantially enlarged in almost all capital increases in public companies. Foreign investors participated in about one third of the 20 private financing rounds, demonstrating that German companies are able to attract high levels of interest. Most of the rounds so far, however, have remained at a comparably low level, with less than €10m involved, so it remains to be seen whether the investors will be willing to put in further capital in the long run.

The top financing of 2015 was the multimillion investment by the Bill and Melinda Gates foundation into Tübingen-based RNA specialist CureVac.

It demonstrated an accolade for German biotech expertise and drew huge attention to the local scene. Some major licensing deals, such as SuppreMol with Baxter and BioNTech with Eli Lilly and Sanofi, further support the theory that German firms are quite attractive from an international point of view.

The growing attractiveness of German technology platforms also was also underlined by several mergers and acquisitions. Five out of 11 buyers came from abroad, four others were German-German transactions for further consolidations of the sector – yet another sign of increased maturity that has been achieved in recent years.

Methodology

Since 2006 BIOCOM AG has been providing an overview of the German biotech sector for the information platform biotechnologie.de, based on the OECD definition of biotechnology as it was first described and globally standardised in 2004 (www.oecd.org). From 2006 until June 2015, the platform and the survey were financed by the German Federal Ministry of Education and Research, BIOCOM AG took over full responsibility for the platform and the report from July 2015.

For the purposes of this survey, BIOCOM AG has compiled a questionnaire compliant with the OECD standards as used in the previous surveys. Between January and March 2016, a total of 775 companies were contacted and asked to complete the survey. When deciding on selection of the company, the OECD definition was used alongside an adjustment in line with the company database at BIOCOM AG. 564 of the companies answered either by questionnaire or by telephone, corresponding to a verification rate of 72.3%.

In accordance with the OECD guidelines, when selecting companies to participate, extreme care was taken to include all enterprises which are resident in Germany and which are active in biotechnology. As a result, companies that are majority-owned from outside Germany but have a company office with R&D activities in Germany were also considered. When surveying the employee figures, number of companies and fields of activity, the survey included only the German locations of a company. If an enterprise had more than one location in Germany, only cumulated figures and data for the company as a whole were considered.

With regard to the clinical pipeline of the dedicated biotech companies, special care was taken in this survey to represent the core development activities in this survey – especially in the early clinical development when a wide range of drug candidates are tested in different indications and formulations. For this reason, the report does not include all R&D projects, but focuses on the number of active compounds the company has in phase I and II tests.

With regard to counting newly founded companies, care was taken to compare the data of the current period under review with the data of the period under review of the previous year. This strategy has to be used to obtain a coherent picture because a steady number of new firms emerge continuously throughout the year. Due to the time-consuming founding procedures, the majority of start-ups are only officially registered as new companies a year or more after their initial founding.

The deadline for completion of the survey was 31.12.2015, for counting the start-ups 31.3.2016. Participating companies can be viewed in the biotechnology database at biotechnologie.de. All data published herein is based on the results of the survey. The database also offers an overview of biotechnological research in Germany. Every scientific institute or establishment can be searched for within the database according to a variety of criteria.

OECD Definitions

Biotechnology …

… is defined as the application of science and technology to living organisms, as well as parts, products and models thereof, to alter living or non-living materials for the production of knowledge, goods and services.

A dedicated biotechnology firm …

… is defined as a biotechnology active firm whose predominant activity involves the application of biotechnology techniques to produce goods or services and/or the performance of biotechnology R&D.

An other biotechnologically active firm …

… is defined as a biotechnologically active firm that applies biotechnology techniques for the purpose of implementing new or significantly improved products or processes (per the Oslo Manual (OECD, 1997) for the measurement of innovation). It excludes end users which innovate simply by using biotechnology products as intermediate inputs (for instance, detergent manufacturers which change their formulation to include enzymes produced by other firms via biotechnology techniques).

Definition areas of activity

- Health/Medicin: Development of therapeutics and/or diagnostics for the field of human medicine, drug delivery, human tissue replacement

- Animal health: As above, for veterinary application

- Agrobiotechnology: Genetically modified plants, animals or microorganisms, as well as non-genetically modified plants grown using biotechnological procedures, for use in agriculture or forestry

- Industrial Biotechnology: Biotechnological products and processes for the handling of waste or sewage, for chemical synthesis, for the extraction of raw materials and energy etc.

- Non-specific application: Equipment or reagents based on

biotechnological principles, for research or provision of services in this field

(“ancillary industry”)

Further relevant terms

- Biotechnology product: ... is defined as a good or service, the development of which requires the use of one or more biotechnology techniques based on the list and single definitions above. It includes knowledge products (technical know-how) generated from biotechnology R&D.

- Biotechnology process: ... is defined as a production or other (e.g. environmental) process using one or more biotechnology techniques or products

- Biotechnology research and experimental de-velopment (R&D): ... are defined as R&D into biotech-nology techniques, biotechnology products or biotechnology processes, in accordance with both the biotechnology definitions presented above and the Frascati Manual for the measurement of R&D (OECD, 2002).

- Biotechnology employment: ... is defined as the employment involved in the generation of biotechnology products as defined above. For ease of collection, it is suggested that employment be measured in terms of staff numbers rather than hours worked. However, where countries prefer, they can collect this information in terms of full-time equivalents, consistent with an R&D survey approach (as outlined in the Frascati Manual).