The German Biotechnology Sector 2015

More revenue, more jobs, more funding – all signs are pointing towards growth in the German biotech sector. These are the central conclusions of the company survey carried out by the information platform biotechnologie.de at the beginning of 2015 on behalf of the Federal Ministry of Education and Research (BMBF). In 2014, the turnover exceeded the milestone of 3 billion euros for the very first time. For the first time since 2008, spending on research and development (R&D) has increased once again.

Clinical pipeline

The potential of a technology or a research approach, or of the level of maturity reached by a medical biotechnology company, is mirrored by the number of drug candidates and the respective status of clinical development. Each step and phase comes with its own unique hurdles, and each ongoing stage of development is frequently associated with larger investments and higher risk. Whether in Germany or elsewhere, according to expert assessments, the development of a new drug now costs from one to three billion euros, and takes ten to 15 years. And yet, only one in 10,000 active substances will succeed in completing the journey from initial discovery to a place on the market.

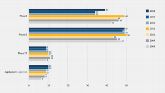

In light of the above, a look at the current pipeline in German drug development gives an insight on the maturity and capacity for innovation in the entire sector. In this regard, 2014 was a year of ups and downs. Some companies were forced to put their development projects on ice, while others took a big step towards approval. Last year, a total of 97 biologically active compounds were in one of the three phases of clinical development, a slight increase of six compared to the previous year (2013: 91; 2012: 93). This reflects that the drug developers apparently had once again enough financial resources to advance their clinical candidates.

There is a gratifying increase in the first clinical phase: 39 active substances were recorded in phase I (2013: 34). Thus the downward trend of previous years has been stopped. Five preclinical projects had their clinical research debut in the course of 2014, including candidate IMAB027 from Mainz-based Ganymed Pharmaceuticals AG. Their antibody for the treatment of ovarian cancer is a product from the company’s own Ideal Monoclonal Antibody Platform (IMAB). It now represents the second antibody on clinical trials so far.

Heidelberg-based firm Affimed was not only ready to go public on NASDAQ in 2014, they also started a phase I study for their bifunctional monoclonal antibody AFM11 for the treatment of blood cancer patients. The molecule emerged from Affimed’s own TandAb technology platform and a phase II study was started for the most advanced candidate AFM13.

The majority of clinical candidates of German companies were in phase II in 2014, coming to a total of 49 active substances (2013: 48). Amongst them is a RNA-based immunotherapy developed by CureVac from Tübingen. CV9104 is one of three CureVac products in phase II. This also applies to NOXXON, Glycotope and Silence Therapeutics: each of these Berlin-based companies also has three candidates in phase II. As a result of an acquisition in 2014, Munich-based company Medigene AG was able to boost its pipeline with a new phase II product: the immunotherapeutic candidate was orginially developed by Trianta, a spin-off from the Helmholtz Zentrum Munich.

There was little change in the number of active substances in phase III. Here, a total of nine drug candidates were recorded in 2014 (four biologics, five small molecules) – the same as in 2013 (see Table 3). There were some changes though. Candidate MGN1703 from Berlin-based MOLOGEN AG has progressed into phase III. The immuno therapy will be tested for the treatment of metastatic colorectal cancer. New on the list of current phase III candidates is the compound LT-02 from Lipid Therapeutics GmbH. The spin-off from the University Hospital Heidelberg develops novel therapies for inflammatory diseases of the digestive system. LT-02, a delayed release formulation of phosphatidylcholine, is tested for the treatment of patients suffering from ulcerative colitis. The clinical study is performed with support from Dr. Falk Pharma GmbH based in Freiburg.

In 2014, Hamburg-based biotech company Evotec and its former diabetes drug DiaPep277 found themselves a victim of an alleged data scandal. DiaPpep277 was originally licensed out from Göttingen-based Develogen AG to Israeli start-up Andromeda Biotech in 2007. With the acquisition of Develogen in 2010, the rights for the project landed in the Evotec portfolio. In April 2014, US drug developer Hyperion Pharmaceuticals acquired Andromeda with the aim of securing access to DiaPep277.

For the Americans, the million-dollar acquisition ended in disaster. Hyperion claimed to have found evidence that employees at Andromeda Biotech resorted to “illegitimate means” in the development of Diapep277. Hyperion has discontinued the development of the molecule and commenced legal action against the responsible parties at Andromeda.

No longer included in the list of drug candidates, is the development pipeline of Bavarian Nordic. The vaccine specialist is headquartered in Denmark but undertakes its scientific work in Germany. However, the development of the most recent candidates takes place outside of Germany. That is why the phase III candidate Prostvac no longer appears on the list. But the 2013 approved smallpox vaccine Imvamune is still counted among the approved drugs, because its development work mainly took place in Germany. Thus, there are now a total of ten biotech drugs on the market that were developed in Germany (see Table 2). The last to join this list, prior to Imvamune, was the product Ameluz from Biofrontera AG.