The German Biotechnology Sector 2015

More revenue, more jobs, more funding – all signs are pointing towards growth in the German biotech sector. These are the central conclusions of the company survey carried out by the information platform biotechnologie.de at the beginning of 2015 on behalf of the Federal Ministry of Education and Research (BMBF). In 2014, the turnover exceeded the milestone of 3 billion euros for the very first time. For the first time since 2008, spending on research and development (R&D) has increased once again.

The German Biotechnology Sector 2015

More revenue, more jobs, more funding – all signs are pointing towards growth in the German biotech sector. Never before have biotech companies generated as much revenue and employed as many people as now. In addition, interest from big business in biotech products remains steady, not only in the healthcare industry but also in the area of the bioeconomy. The number of employees in dedicated biotechnology companies jumped to 17,930 (+5.8%). The total number of these companies increased to 579 (+1.6%). A total of 14 start-ups were founded, which is almost the same amount as the year before (13).

In addition, there were 131 firms that were active in biotechnology, but as only one aspect of their business (2013: 130). A total of 19,200 people worked in the biotechnology-related areas of these companies (+4.1%). Thus, in the year 2014, there were 37,130 jobs places in commercial biotechnology in Germany. The financing situation has undergone a positive development, with around €445m capital raised (+10.2%). These are the central conclusions of the company survey carried out by the information platform biotechnologie.de at the beginning of 2015 on behalf of the Federal Ministry of Education and Research (BMBF). The data was gathered in accordance with the guidelines of the Organisation for Economic Cooperation and Development (OECD; for more methodology).

The structure of biotechnology sector

In terms of basic structure, the biotechnology sector in Germany did not undergo any significant changes in 2014. The total number of companies that are occupied wholly or predominantly with modern biotechnological methods rose slightly to 579 (2013: 570). Thereby, the following figures and conclusions relate only to the ‘dedicated’ biotechnology companies, as defined by the OECD. Throughout, there is sustained interest from big industry in biotechnological processes and services. This is confirmed by the constant high number of companies in which biotechnology represents only one aspect of business. In 2014, this category of ‘other biotechnologically active companies’ comprised a total of 131 companies (2013: 130). These included both pharmaceutical and chemical companies focused on innovative biotechnological processes as well as companies from the areas of environment, waste management, energy and agriculture.With a total of 14 start-ups (2013: 13) and seven bankruptcies (2013: 11) the inflows were predominating the scene. The founding dynamics were at the same level as the year before. Most of the newcomers are active in the health area (10), two of them focus on applications for animals. A further four start-ups can be assigned to the area of non-specific services, among them are two spin-offs founded by scientists of the IMTEK (Institut für Mikrosystemtechnik) at the university of Freiburg: Cytena GmbH has developed a device which safely and gently seperates cells.

The Ionera Technologies GmbH on the other hand provides a universal chip platform for ion-conductance based analytics. This year, three start-ups were founded out of established companies: Tübingen-based CeGaT GmbH initiated CAG GmbH, which specialises in animal research, and CeMeT GmbH, which focuses on microbiome research. Furthermore, the Hamburg-based Immunservice GmbH, founded the company 4 Animal Alsterscience GmbH to applicate their immune-based approaches to horses, amongst others.Two start-ups, Imevax GmbH and Rigontec GmbH, both established from winning projects of the BMBF GO-Bio competition, show that state funded start-up initiatives can have an influence on the founding dynamic. The LMU-spin-off MetaHeps GmbH was systematically supported through a pre-seed funding of the Munich excellence cluster m4. Additionally, the company received funding from the BMWi initiative EXIST. NEUWAY Pharma GmbH is the first start-up to result from the Life Science Inkubator GmbH at the research centre caesar, wherease Berlin Cures GmbH is the first spin-off from the Berlin Institute of Health. In 2014, the highest number of company founders came from Baden-Wuerttemberg (4), followed by Bavaria (3) and North Rhine-Westphalia (3), as well as Hamburg (2) and Berlin (1). The average age of a German biotech company is now eleven years, while some companies have reached thirty years of age – a very respectable age for such a high-risk industry. With the increasing age of the companies, the influence of the BMBF’s BioRegio competition, which took place in the 90s, has subsided. From today’s perspective, just a third (29 %) of the companies began their business activities between 1996 and 2001 in the wake of the competition. The geographical distribution of companies in 2014 shows no significant changes to the previous year. As before, the majority are based in Bavaria (104) and Berlin-Brandenburg (95). Because of the high amount of start-ups, Baden-Wuerttemberg (92) has moved forward, followed by North Rhine-Westphalia (89) (see Table 1).

Employee structure

In terms of the number of employees, the biotechnology sector can be said to be a dynamic employment market. The 131 ‘other’ biotechnologically active companies achieved modest growth. These also include companies in the pharmaceutical, chemical and food sectors. In 2014, a total of 19,200 people were employed in the biotechnology-oriented areas of such companies. Compared to the previous year (2013: 18,450), this represents a growth of almost 4%. Furthermore, the number of employees in the dedicated biotechnology companies has also risen significantly. Over the course of the year, a total of 17,930 people were employed in the 579 dedicated biotech companies active in Germany. This is an increase from the previous year of 5.8 %. Overall, there was an increase in the total headcount of 37,130 (+4.9 %) in commercial biotechnology (2013: 35,400).

The geographical positioning of jobs in the field of biotechnology can be derived from the number of companies in the individual federal states (see Fig. 1). The growing numbers are distributed almost consistently throughout all federal states. The highest increase was in North Rhine-Westphalia (+210) and Baden-Wuerttemberg (+190) as well as Bavaria and Hamburg with an increase of 140 employees. However, the ranking of the highest number of employees in the states did not change. The most employees of dedicated biotechnology companies are still located in North Rhine-Westphalia (3,890), whereby the largest biotech companies Qiagen and Miltenyi employ the bulk of workers there. Bavaria (3,520) and Baden-Wuerttemberg (2,770) follow in second and third place. With 1,500 employees, Hesse was able to consolidate fourth place in the ranking. Following Hesse is Berlin (1,440), Hamburg (940), Brandenburg (810) and Rhineland-Palatinate (650). The federal states of Saxony (520), Lower Saxony (510) and Mecklenburg-West Pomerania (480), as well as the federal states of Saxony-Anhalt (340) and Schleswig-Holstein (200) all have a relatively similar level of employees.

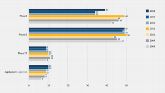

The average size of dedicated companies shows that the majority are still very small. Almost every second company (44.7%) has fewer than ten employees on its books, but its relative share is decreasing, which shows a maturing pro-cess of the sector. In 2013, the number of the smallest biotech companies was higher at 46%. No changes can be reported regarding the number of companies (40.4%), which have between ten and fifty employees. Businesses with more than 100 employees are still the exception, but its numbers are growing constantly. In 2013, only 30 companies were counted in this category, in 2014, 35 companies can claim to belong to this uppermost group. Nine companies in this group – one more than 2013 – employ over 250 people and thus no longer count as small or medium-sized enterprises (SME). With 1,400 employees, Qiagen is by far Germany’s largest biotechnology company. The second place goes to Miltenyi Biotec (1,060 employees), which focuses on cell technologies for medical applications. With over 580 employees, the biopharmaceutical contract manufacturer Rentschler Biotechnologie in Baden-Wuerttemberg retains third place.

Fields of activity

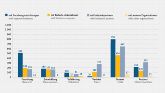

Observers of the German biotech sector will have noted a pretty unchanged picture of the sector with regard to focal areas: the central task of most biotech companies is the development of drugs or new diagnostic methods. 287 companies (49.6 %) belong to the field of ‘red’ biotechnology – a proportion that has remained steady for many years. Nevertheless, in the area of medical biotechnology, several key activities have been established over the years in Germany, and some shifts can be seen to have taken place. A growing number of companies specialise on novel applications in the field of diagnostics. In 2014, there were 82 companies active in this area, which is five more than in 2013. The large majority of firms working in medically oriented biotechnology are either still in the preclinical stage of therapeutical research or developing technology platforms in the field of health. In 2014, this figure increased by four companies to 154. Once again, this demonstrates the growing importance of broadly applicable technology platforms in modern drug development – either with regard to active substance classes or to indications.

In Germany, the companies are well positioned in this area. For example, there has been a rise in the number of individual firms that are concentrating on the development of therapeutics and which already have one or more products in the clinical pipeline up to phase I. In 2014, there were 51 companies active in this area; which is still not the level of 2012 (55), but compared to the previous year (48) the number rose by three.

With a total of 186 companies, a large portion of the sector (32.1%) is still not active in any specific field (2013: 188). This includes all companies providing services exclusively or primarily for other biotech firms, or which function as suppliers. Pure contract manufacturers of biological molecules without their own research and development activities are also defined by the OECD as non-specific. This segment is thus the second most important in the biotech sector, with the overall figures underlining its increasing importance.

Going by the numbers alone, it is possible to conclude that stagnation is taking place in Germany with regard to companies in industrial or ‘white’ biotechnology. In 2014, a total of 57 companies were active in this area – one less than last year. The companies recorded here are focused on topics such as the development of technical enzymes, new biomass utilisation strategies or biotechnological production processes for various branches of industry. The different specialisations of these companies were also recorded (multiple categories were possible) for the second time. Accordingly, the majority are active in the area of feed/food (34) and pharmaceutical production (30). Growing in significance is the cosmetics sector (20), which surpassed the chemicals (18) and energy (13) sectors. Again, this demonstrates that the importance of industrial biotechnology is greater than might be concluded from a consideration of the small group of companies active here. This is largely because all of the above-named sectors are undergoing a shift towards a bio-based, sustainable and resource-efficient economy, primarily supported by new technological developments in industrial biotechnology.

Another important pillar for the bio-based economy is in the form of farmers and plant breeders. Among other things, plant biotechnology can contribute to the development of the robust crops that are needed in Germany and abroad in the light of climate change. A total of 19 companies in Germany can be counted in the application field of ‘green’ biotechnology. Compared to the previous year, this sector has undergone a slight decrease (2013: 21). Much like industrial biotechnology, the field is largely dominated by large companies that can shoulder the lengthy development and approval processes, but which nevertheless appear in the statistics of other firms active in biotechnology. Both ‘white’ and ‘green’ biotechnology are thus important components of a sector that is set to play an important role in the sustainable transition and in the establishment of the bioeconomy. The geographical distribution of both of these fields is shown in Figure 4.

With 30 companies (5.2 %) active in bioinformatics, this can be seen as a steadily growing group in Germany that, among other things, is increasingly central for the development of individualised treatment strategies. The work that is currently being carried out in this area requires modern high-throughput methods to systematically collect and analyse increasingly large volumes of medically relevant data. The entire genomes of a growing number of people have now been sequenced and are available as data sets. The same trend also increasingly applies to other information areas, such as the epigenome, proteome or metabolome. From a prognostic, diagnostic or therapeutic perspective, these data sets contain vast quantities of potentially valuable information that is still to undergo thorough evaluation. The key to extracting this treasury of knowledge is to be found in the information sciences. Initial analyses of such data sets have already indicated that, for each individual person, there are characteristic patterns and signatures for potential forms of individualised prevention and more comprehensive diagnosis, as well as any subsequent individualised therapies. Thus, the field of bioinformatics is fundamental for precision medicine. In addition, this also applies to agriculture and plant breeding. Technologies such as automated phenotyping or marker assisted selection generate enormous amounts of data that must be handled and analysed. Bioinformatics is an important tool to extract insights from the mountains of data and use it for applications in all segments of the biotech sector.

Clinical pipeline

The potential of a technology or a research approach, or of the level of maturity reached by a medical biotechnology company, is mirrored by the number of drug candidates and the respective status of clinical development. Each step and phase comes with its own unique hurdles, and each ongoing stage of development is frequently associated with larger investments and higher risk. Whether in Germany or elsewhere, according to expert assessments, the development of a new drug now costs from one to three billion euros, and takes ten to 15 years. And yet, only one in 10,000 active substances will succeed in completing the journey from initial discovery to a place on the market.

In light of the above, a look at the current pipeline in German drug development gives an insight on the maturity and capacity for innovation in the entire sector. In this regard, 2014 was a year of ups and downs. Some companies were forced to put their development projects on ice, while others took a big step towards approval. Last year, a total of 97 biologically active compounds were in one of the three phases of clinical development, a slight increase of six compared to the previous year (2013: 91; 2012: 93). This reflects that the drug developers apparently had once again enough financial resources to advance their clinical candidates.

There is a gratifying increase in the first clinical phase: 39 active substances were recorded in phase I (2013: 34). Thus the downward trend of previous years has been stopped. Five preclinical projects had their clinical research debut in the course of 2014, including candidate IMAB027 from Mainz-based Ganymed Pharmaceuticals AG. Their antibody for the treatment of ovarian cancer is a product from the company’s own Ideal Monoclonal Antibody Platform (IMAB). It now represents the second antibody on clinical trials so far.

Heidelberg-based firm Affimed was not only ready to go public on NASDAQ in 2014, they also started a phase I study for their bifunctional monoclonal antibody AFM11 for the treatment of blood cancer patients. The molecule emerged from Affimed’s own TandAb technology platform and a phase II study was started for the most advanced candidate AFM13.

The majority of clinical candidates of German companies were in phase II in 2014, coming to a total of 49 active substances (2013: 48). Amongst them is a RNA-based immunotherapy developed by CureVac from Tübingen. CV9104 is one of three CureVac products in phase II. This also applies to NOXXON, Glycotope and Silence Therapeutics: each of these Berlin-based companies also has three candidates in phase II. As a result of an acquisition in 2014, Munich-based company Medigene AG was able to boost its pipeline with a new phase II product: the immunotherapeutic candidate was orginially developed by Trianta, a spin-off from the Helmholtz Zentrum Munich.

There was little change in the number of active substances in phase III. Here, a total of nine drug candidates were recorded in 2014 (four biologics, five small molecules) – the same as in 2013 (see Table 3). There were some changes though. Candidate MGN1703 from Berlin-based MOLOGEN AG has progressed into phase III. The immuno therapy will be tested for the treatment of metastatic colorectal cancer. New on the list of current phase III candidates is the compound LT-02 from Lipid Therapeutics GmbH. The spin-off from the University Hospital Heidelberg develops novel therapies for inflammatory diseases of the digestive system. LT-02, a delayed release formulation of phosphatidylcholine, is tested for the treatment of patients suffering from ulcerative colitis. The clinical study is performed with support from Dr. Falk Pharma GmbH based in Freiburg.

In 2014, Hamburg-based biotech company Evotec and its former diabetes drug DiaPep277 found themselves a victim of an alleged data scandal. DiaPpep277 was originally licensed out from Göttingen-based Develogen AG to Israeli start-up Andromeda Biotech in 2007. With the acquisition of Develogen in 2010, the rights for the project landed in the Evotec portfolio. In April 2014, US drug developer Hyperion Pharmaceuticals acquired Andromeda with the aim of securing access to DiaPep277.

For the Americans, the million-dollar acquisition ended in disaster. Hyperion claimed to have found evidence that employees at Andromeda Biotech resorted to “illegitimate means” in the development of Diapep277. Hyperion has discontinued the development of the molecule and commenced legal action against the responsible parties at Andromeda.

No longer included in the list of drug candidates, is the development pipeline of Bavarian Nordic. The vaccine specialist is headquartered in Denmark but undertakes its scientific work in Germany. However, the development of the most recent candidates takes place outside of Germany. That is why the phase III candidate Prostvac no longer appears on the list. But the 2013 approved smallpox vaccine Imvamune is still counted among the approved drugs, because its development work mainly took place in Germany. Thus, there are now a total of ten biotech drugs on the market that were developed in Germany (see Table 2). The last to join this list, prior to Imvamune, was the product Ameluz from Biofrontera AG.

Cooperations

The biotechnological innovations that are gaining traction today in the pharmaceutical, chemical and food sectors are often significantly more sustainable than traditional technologies and processes. This has been recognised by large corporations as well as medium-sized companies. The pressing question of whether, and under which conditions such a transformation is worthwhile, is the focus of joint R&D projects with other companies, research institutions or organisations. In 2014, together with partners from research and industry, the 186 companies recorded in the current survey undertook collaborations in nearly 2,000 separate projects.

Almost one-quarter (513) of all collaborations with research facilities relate to questions of basic research. Likewise, there are numerous ties with industry (647), and even among themselves, the biotechnology companies in the survey managed to notch up a total of 474 partnerships. Thereby, the cooperations are distributed across the entire value chain, with a predictably strong focus on research (890) and development (519). Ranking significantly below are the areas of validation (214) and sales cooperations (414). Almost every second industrial cooperation now extends across national boundaries (48.7 %); in the case of academic partnerships, this is more than one in four (26.7 %).

Financing

The financial situation mirrors the growth trend: in 2014, around €445m was invested in German biotech companies compared (2013: €401m) to the year before a significant plus of 10%. The private firms in particular have gained the most – they increased the amount of raised money by 26%: The public capital market shows a divided picture: on the one hand, the German biotech sector finally saw new listings, but on the other hand follow-on and other financings via the stock exchange decreased in 2014 by 30%. A new development was seen with regard to public funding: with €44m, the share of this money significantly decreased by 10% for the first time in ten years.

2014 was the year that the US stock market boom arrived in Germany. For the first time since 2007, the list of publicly traded German biotech companies grew by three. But they all chose a stock market launch far from their home markets. Two companies went public in the US (Affimed, Pieris) and one floated on the exchange in Amsterdam (Probiodrug). A total of €70m in captial was raised during the three listings. Heidelberg-based Affimed took a detour by founding a dutch holding – Affimed Therapeutics BV and raised €43.5m on NASDAQ. Before the stock market launch, it closed a financial series E round and a loan – worth €22m in total – to generate some financial scope. Aeris Capital, BioMedInvest, LSP Life Sciences Partners, Novo Nordisk A/S and Orbimed came in as investors. Halle-based Probiodrug on the other hand raised a total of €23.2m via its IPO on Euronext/Amsterdam, despite turbulent capital markets at the time. The collected money will flow into Probiodrug’s lead product PQ912 in particular, as well as in the development candidate PQ1565. The low-molecular glutaminyl cyclase inhibitors are aimed at the treatment for Alzheimer’s patients. The same indication is planned for the monoclonal antibody PBD-C06 which targets against pyroglutamate and is also in the clinical pipeline of Probiodrug.

With regard to follow-on and other financings via the stock market, compared to 2013, the situation in 2014 was worse. In total, the listed companies only raised €152m (-30%). In 2013, the sum was €218m. The highest amount poured in was by capital increase of PAION AG. The company received net proceeds of €46.3m. The money will be used primarily for the further development of Remimazolam in the US and the EU. A surprising coup came from Hamburg-based Evotec AG at the end of 2014. The company announced a strategic alliance with French pharma concern Sanofi and the acquisition of the Toulouse plant of Sanofi counting a total of 200 employees.

With reference to privately financed firms, the year 2014 heralded a new upswing trend. With 18 financing rounds, a total of €172m was raised. In comparison to 2013, this sum meant an increase of 26%, but still does not reached the level of capital raised in 2012 (€205m). As in the previous year, all investor funding – with one exception – was earmarked for drug developers. But in the field of industrial biotechnology, the company BRAIN AG drew attention to itself with two acquisitions. In July, the company took a majority holding in AnalytiCon Discovery, a specialist of natural products based in Potsdam. In November, the Zwingenberg-based firm engaged into the industrial enzyme producer WeissBioTech GmbH located in Ascheberg.

Albeit far less than the previous year, investments were dominated by the two most active German family offices Strüngmann and Hopp. In 2014, only five of 18 rounds saw a participation of these investors. Nevertheless, they took part in the largest financing round of 2014. In March, the Berlin-based Glycotope raised a total of €55m. The fresh capital injunction basically came from Jossa Arznei GmbH, which is located in Munich and belongs to the Strüngmann Group, and from ELSA GmbH, owned by Berlin investor Andreas Eckert. The money will be used for clinical Phase IIb studies of the two anticancer drugs Pankomab-Gex and Cetugex. In addition, the fertility hormone FSH-Gex will also be moved into phase III studies, and, if successful, will be marketed from 2017.

In addition, via its investment company AT NewTec GmbH, the Strüngmann family office became involved in the Munich-based Isarna Therapeutics GmbH, which emerged from the former company Antisense Pharma. Under the new name, the firm succeeded in raising a total of €13m. MIG fonds were also among the investors. The capital will be invested in the clinical development of DNA-based drugs. To date, Isarna has two molecules in the preclinic.

Fresh funds also were provided for Curetis AG in Holgerlingen, which is predominantly financed by institutional investors. By 2011, the molecular diagnostics specialist had already raised €24m from Forbion Capital Partners, the Roche Venture Fund and CD Venture, a fund owned by Christoph Boehringer. In 2013, a further €12.5m was collected and HBM was won as new lead investor. In 2014, the company again closed a €14.5m financing round. This time around, Germany’s largest biotech company Qiagen also participated as investor. The money will be used to strengthen further international marketing of the DNA-based test systems for the analysis of clinical samples.

Furthermore, a number of start-ups also succeeded in securing seed financing, partly with the support of the federal High-Tech Gründerfonds (HTGF). This also included Myr GmbH from Burgwedel, which raised €7.9m of capital. Alongside HTGF, the Russian investor Maxell Biotech Venture Fund also took part in the round. Ayoxxa Biosystems GmbH, another HTGF financed company, succeeded in closing a series B financing round of €11.3m. Apart from former investors HTGF, KfW, NRW.Bank and Wellington Partners, the Swiss investors network b-to-v Partners, the venture capitalists Creathor Venture, HR Ventures, BioMedPartners AG and Grazia Equity GmbH as well as some private investors, among them the Qiagen founder Detlef Riesner, took part for the first time.

The two start-ups Imevax from Munich and Zellkraftwerk from Hanover enjoyed a further multimillion funding within the framework of the BMBF-financed founding initiative GO-Bio. In 2014, Imevax – a spin-off from the TU Munich – succeeded in closing a financing round of €7.5m, in which Wellington Partners, BioMedPartners, EMBL Ventures and Santo Venture Capital, another investment company of the Strüngmann brothers, participated. Another GO-Bio winning team from Bonn, now running a young company under the name of Rigontec GmbH, also secured a financing round in 2014. They raised a total of €9.5m. Among the investors of the RNA specialist were the HTGF and the Boehringer Ingelheim Venture Fund.

With the participation of the Bavarian Patentallianz GmbH, the LMU and the Max-Planck-Society, the MODAG GmbH from Wendelsheim managed to raise a state funded seed financing of €8m. The joint project of the LMU and the Max Planck Institute of biophysical chemistry in Göttingen – started in 2014 – aims to develop a new therapy for Parkinson’s disease. The start-up was decorated as the winner of the PEP Award 2014 in the category “founding projects in the seed phase” for its new Parkison’s therapy approach. PEP is a promotive programme of the BMBF. Also recognised in this initiative was the NEUWAY Pharma GmbH, which is the first biotech start-up realised by the Life Science Inkubator at the research centre caesar in Bonn. With the help of the incubator, the ZNS focused company already secured a €2.3m seed financing. In 2014, the firm managed to close a series A financing of €2.7m. Wellington Partners participated as lead investor.

Lophius Biosciences GmbH, a diagnostic company with a focus on T cells, which was founded by scientists of the University of Regensburg, secured a smaller fincancing round of €2m. VRD GmbH from Heidelberg, which is already engaged in the start-up, was once again the lead investor. Further financiers included the HTGF, the S-Refit AG from Regensburg as well as another former investor.A combined seed and series A financing of €1.7m was announced by the Cologne-based vaccine developer CAP-CMV GmbH. The round was led by the Charité Biomedical Fund, which is managed by Peppermint VenturePartners (PVP). Further investors included NRW.Bank, Creathor Venture, KfW and private investors. The start-up was founded in 2013 by CEVEC Pharmaceuticals GmbH and is focused on the development of new vaccines for the treatment of human cytomegalovirus (HMCV).

An alternative financing source was unlocked by Oaklabs GmbH in 2014. The bioinformatics company founded in the federal state of Brandenburg in 2011, raised €300,000 through a campaign on the German crowdfunding platform seedmatch.de, which was given as a convertible loan. In 2014, the Radebeul-based company Riboxx GmbH also started a crowdfunding campaign on this platform and managed to secure €1m during the first months of 2015.

All these developments show that the financial situation of companies significantly ameliorated – in spite of the still existing criticism with regard to unsufficient framework conditions. On the one hand, there is the possibility of new listings for German companies – mostly because of the positive trend in the US and Europe. This opens new exit routes for investors and gives alternatives to trade sales. But the Frankfurt stock exchange is still not an attractive option for local firms. It remains to be seen if the new pre-IPO platform will change this situation. On the other hand, privately financed companies saw a significant upswing in 2014. Although there were almost no large double digit financing rounds closed, a number of promising start-ups and young companies secured comparably high series A financing rounds with the participation of diverse investors. The dominance of family offices seen over the few last years clearly decreased in 2014. Instead, former biotech founders, corporate venture funds as well as foreign investors have engaged more and more. Another good sign is the positive development of state funded start-up projects – whether it’s via the HTGF, the BMBF initiative GO-Bio or the Life Science Inkubator in Bonn.

Development of turnover and R&D expenditure

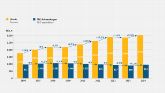

In regards to turnover, 2014 was a record year – for the first time revenues surmounted the level of €3bn (2013: €2.86bn). Compared to the previous year, this means a plus of 5.8%. .The revenues recorded in the statistics derive from both the sale of products and services as well as from upfront and milestone payments through licensing agreements. Spending on research and development (R&D) showed a positive tendency. For the first time since 2008, spending on R&D projects was on the rise by 6.2% to €954m in 2014 (2013: €899m; 2012: €930m).

These positive developments were present throughout the different application fields of biotechnology. ‘Red’ biotechnology, which comes to a total of €2.08bn – two thirds of the total – continues to be the most important source of revenue. There was a clear increase of 7.1% compared to the previous year. Industrial biotechnology also recorded a growth. Here, the figures rose by 4% to €214m (2013: €206m). There was a similarly positive and ongoing development in the market for companies offering non-specific services (€676m, +2.3%) and bioinformatics applications (€36m). Bioinformatics specialists revenues rose by a remarkable 28%. Due to fewer companies active in the area of plant biotechnology, the revenue is further on the decrease: after €44m in 2012, the most recent figure came to just €30.5m.

Nevertheless, the economic significance of biotechnology is far greater than is suggested by the revenues at the dedicated companies. A much larger proportion of the revenue generated by biotechnological methods and techniques – such as biopharmaceuticals, diagnostics or reagents – derives from the 131 ‘other’ biotechnologically-active companies, and is not recognised in this survey. In the health sector in particular, biotech drugs are among the best-selling medicinal products, and large sums of money are already being generated by biotechnological products in the chemicals as well as and in other sectors, such as cosmetics.

The increase in R&D spending can largely be subscribed to medical biotechnology companies. At €773m euros, they contributed the bulk of R&D expenditure, an increase of 7.4 % compared to 2013 (€720m).

Like the previous year, an equally high R&D budget (2013: €48m) was put to use by companies active in industrial biotechnology (€47m). Similar developments were seen in the case of companies in the field of non-specific services – there R&D expenditure remained at €106m, as it did in 2013. In the area of plant biotechnology the declining trend can be seen: The companies only invested €15m in R&D, a smaller sum compared to the €16m invested in the previous year (-9 %).

Methodology

In December 2004, the OECD standardised the huge range of existing definitions of the term biotechnology. Since then, all OECD countries have been called upon to carry out surveys on biotechnology, following the so-called Framework for Biotechnology Statistics (www.oecd.org). The OECD recognises two different categories of companies within the biotech industry: dedicated biotechnology company and other biotechnologically active companies. The first of these definitions, according to the OECD, applies to biotechnologically active enterprises, whose core company goals are the application of biotechnological procedures in the manufacturing of products, the supply of services or in the execution of biotechnological research and development.

Unlike the dedicated biotech companies, the central aims of other biotechnologically active companies do not exclusively lie in the application of biotechnological procedures. The OECD thereby also includes in this category companies where biotechnology makes up only one part of the business activity. Companies are defined as biotechnologically active companies if they use biotechnological procedures for recently developed or significantly improved products or production processes. The central company aims must not be solely in the use of biotechnological procedures for the production of products, the supply of services or in the execution of biotechnological research and development. Examples of such companies are pharma firms, chemical companies or seed manufacturers.

For the purposes of this survey, biotechnologie.de has compiled a questionnaire, which is based on the OECD definition as described above. Between January and March 2014, a total of 774 companies were contacted and requested to complete the survey. When deciding on the company selection, the OECD definition was used alongside an adjustment with the company database at BIOCOM AG. 536 of the companies answered either by questionnaire or by telephone, corresponding to a verification rate of 72 %.

In accordance with the OECD guidelines, while selecting companies to participate, extreme care was taken to include all enterprises which are resident in Germany and which are active in biotechnology. Therefore, companies that are majority-owned from outside Germany but have a company office with R&D activities in Germany were also considered. In surveying the employee figures, number of companies and fields of activity, the survey included only the German locations of a company. If an enterprise had more than one location in Germany, only cumulated figures and data for the company as a whole were considered.

Concerning the clinical pipeline of the dedicated biotech companies, special care was taken to represent the core development activities in this survey – especially in the early clinical development, when a wide range of drug candidates are tested in different indications and formulations. For this reason the report does not include all R&D projects, but focuses on the number of active compounds the company has in phase I and II tests. With regard to counting newly founded companies, care was taken to compare the data of the current period under review with the data of the period under review of the previous year. A coherent picture can only emerge using this strategy, because a steady number of new firms continuously emerge throughout the year. Due to the time consuming official founding procedures, the majority of start-ups are only officially registered as new companies a year or more after their initial founding.

The deadline for completion of the survey was 31.12.2014, for counting the start-ups 31.3.2015. Participating companies can be viewed in the biotechnology database at the information portal biotechnologie.de. All data published herein is based on the results of the survey.

OECD Definitions

Biotechnology …

… is defined as the application of science and technology to living organisms, as well as parts, products and models thereof, to alter living or non-living materials for the production of knowledge, goods and services.

A dedicated biotechnology firm …

… is defined as a biotechnology active firm whose predominant activity involves the application of biotechnology techniques to produce goods or services and/or the performance of biotechnology R&D.

An other biotechnologically active firm …

… is defined as a biotechnologically active firm that applies biotechnology techniques for the purpose of implementing new or significantly improved products or processes (per the Oslo Manual (OECD, 1997) for the measurement of innovation). It excludes end users which innovate simply by using biotechnology products as intermediate inputs (for instance, detergent manufacturers which change their formulation to include enzymes produced by other firms via biotechnology techniques).

Definition areas of activity

- Health/Medicin: Development of therapeutics and/or diagnostics for the field of human medicine, drug delivery, human tissue replacement

- Animal health: As above, for veterinary application

- Agrobiotechnology: Genetically modified plants, animals or microorganisms, as well as non-genetically modified plants grown using biotechnological procedures, for use in agriculture or forestry

- Industrial Biotechnology: Biotechnological products and processes for the handling of waste or sewage, for chemical synthesis, for the extraction of raw materials and energy etc.

- Non-specific application: Equipment or reagents based on

biotechnological principles, for research or provision of services in this field

(“ancillary industry”)

Further relevant terms

- Biotechnology product: ... is defined as a good or service, the development of which requires the use of one or more biotechnology techniques based on the list and single definitions above. It includes knowledge products (technical know-how) generated from biotechnology R&D.

- Biotechnology process: ... is defined as a production or other (e.g. environmental) process using one or more biotechnology techniques or products

- Biotechnology research and experimental de-velopment (R&D): ... are defined as R&D into biotech-nology techniques, biotechnology products or biotechnology processes, in accordance with both the biotechnology definitions presented above and the Frascati Manual for the measurement of R&D (OECD, 2002).

- Biotechnology employment: ... is defined as the employment involved in the generation of biotechnology products as defined above. For ease of collection, it is suggested that employment be measured in terms of staff numbers rather than hours worked. However, where countries prefer, they can collect this information in terms of full-time equivalents, consistent with an R&D survey approach (as outlined in the Frascati Manual).

Prospects

The development over the last few years shows that the German biotechnology sector is well-established and highly innovative. Never before has the industry generated as much revenue as in 2014, and there have never been as many people employed in the sector as now. This means that industrial demand for biobased processes, products and services has been constantly increasing for years now. At the same time, this development has been heavily supported by the German federal government. Thus, both science and business in Germany managed to establish the expertise needed in this field.

Under the umbrella of the bioeconomy, biotechnology has developed a solid foothold in advancing strategies of sustainability througout the different industrial sectors. Biotechnology also plays an important role with regard to new drugs and diagnostics, whether its for the treatment of widespread or rare diseases. Biotech drugs are among the blockbusters in the pharma industry, and for many years the numbers of new approvals in this area have been increasing. This development is reflected in the German biotech sector: Most biotech companies are active in healthcare. But considering the high costs for investments in research and development (R&D) and long development times, these companies face special challenges.

In particular, the concern for sufficient financial ressources is a constant companion for the sector. But 2014 could be a turning point. The key indicators demonstrate that the positive global investment climate for biotech companies has arrived in Germany. Although there is still some catching up to do in regards to a suitable tax framework for investments and the willingness to put money into high-risk projects is less pronounced in this country than elsewhere, there are more signs that point towards growth. In 2014, the highest amount of capital was raised since 2011. In addition, the investors base was broader compared to 2013, which means a decreased dominance of familiy offices. Instead other financiers regained influence: the German pharma industry cooperates more and more with German biotech companies, as the examples of MorphoSys (Merck) und CureVac (Boehringer) showed. The most recent developments in spring 2015 additionally confirm the fact that the German sector is highly attractive for international investors. For the first time, alternative financial instruments such as crowdfunding were also used by biotech firms. A new dynamic was seen in the public sector, too. Hopefully, the Frankfurt stock exchange will once again open for biotech newcomers in the near future.