The German Biotechnology Sector 2015

More revenue, more jobs, more funding – all signs are pointing towards growth in the German biotech sector. These are the central conclusions of the company survey carried out by the information platform biotechnologie.de at the beginning of 2015 on behalf of the Federal Ministry of Education and Research (BMBF). In 2014, the turnover exceeded the milestone of 3 billion euros for the very first time. For the first time since 2008, spending on research and development (R&D) has increased once again.

Fields of activity

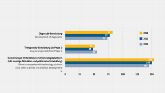

Observers of the German biotech sector will have noted a pretty unchanged picture of the sector with regard to focal areas: the central task of most biotech companies is the development of drugs or new diagnostic methods. 287 companies (49.6 %) belong to the field of ‘red’ biotechnology – a proportion that has remained steady for many years. Nevertheless, in the area of medical biotechnology, several key activities have been established over the years in Germany, and some shifts can be seen to have taken place. A growing number of companies specialise on novel applications in the field of diagnostics. In 2014, there were 82 companies active in this area, which is five more than in 2013. The large majority of firms working in medically oriented biotechnology are either still in the preclinical stage of therapeutical research or developing technology platforms in the field of health. In 2014, this figure increased by four companies to 154. Once again, this demonstrates the growing importance of broadly applicable technology platforms in modern drug development – either with regard to active substance classes or to indications.

In Germany, the companies are well positioned in this area. For example, there has been a rise in the number of individual firms that are concentrating on the development of therapeutics and which already have one or more products in the clinical pipeline up to phase I. In 2014, there were 51 companies active in this area; which is still not the level of 2012 (55), but compared to the previous year (48) the number rose by three.

With a total of 186 companies, a large portion of the sector (32.1%) is still not active in any specific field (2013: 188). This includes all companies providing services exclusively or primarily for other biotech firms, or which function as suppliers. Pure contract manufacturers of biological molecules without their own research and development activities are also defined by the OECD as non-specific. This segment is thus the second most important in the biotech sector, with the overall figures underlining its increasing importance.

Going by the numbers alone, it is possible to conclude that stagnation is taking place in Germany with regard to companies in industrial or ‘white’ biotechnology. In 2014, a total of 57 companies were active in this area – one less than last year. The companies recorded here are focused on topics such as the development of technical enzymes, new biomass utilisation strategies or biotechnological production processes for various branches of industry. The different specialisations of these companies were also recorded (multiple categories were possible) for the second time. Accordingly, the majority are active in the area of feed/food (34) and pharmaceutical production (30). Growing in significance is the cosmetics sector (20), which surpassed the chemicals (18) and energy (13) sectors. Again, this demonstrates that the importance of industrial biotechnology is greater than might be concluded from a consideration of the small group of companies active here. This is largely because all of the above-named sectors are undergoing a shift towards a bio-based, sustainable and resource-efficient economy, primarily supported by new technological developments in industrial biotechnology.

Another important pillar for the bio-based economy is in the form of farmers and plant breeders. Among other things, plant biotechnology can contribute to the development of the robust crops that are needed in Germany and abroad in the light of climate change. A total of 19 companies in Germany can be counted in the application field of ‘green’ biotechnology. Compared to the previous year, this sector has undergone a slight decrease (2013: 21). Much like industrial biotechnology, the field is largely dominated by large companies that can shoulder the lengthy development and approval processes, but which nevertheless appear in the statistics of other firms active in biotechnology. Both ‘white’ and ‘green’ biotechnology are thus important components of a sector that is set to play an important role in the sustainable transition and in the establishment of the bioeconomy. The geographical distribution of both of these fields is shown in Figure 4.

With 30 companies (5.2 %) active in bioinformatics, this can be seen as a steadily growing group in Germany that, among other things, is increasingly central for the development of individualised treatment strategies. The work that is currently being carried out in this area requires modern high-throughput methods to systematically collect and analyse increasingly large volumes of medically relevant data. The entire genomes of a growing number of people have now been sequenced and are available as data sets. The same trend also increasingly applies to other information areas, such as the epigenome, proteome or metabolome. From a prognostic, diagnostic or therapeutic perspective, these data sets contain vast quantities of potentially valuable information that is still to undergo thorough evaluation. The key to extracting this treasury of knowledge is to be found in the information sciences. Initial analyses of such data sets have already indicated that, for each individual person, there are characteristic patterns and signatures for potential forms of individualised prevention and more comprehensive diagnosis, as well as any subsequent individualised therapies. Thus, the field of bioinformatics is fundamental for precision medicine. In addition, this also applies to agriculture and plant breeding. Technologies such as automated phenotyping or marker assisted selection generate enormous amounts of data that must be handled and analysed. Bioinformatics is an important tool to extract insights from the mountains of data and use it for applications in all segments of the biotech sector.