The German Biotechnology Sector 2015

More revenue, more jobs, more funding – all signs are pointing towards growth in the German biotech sector. These are the central conclusions of the company survey carried out by the information platform biotechnologie.de at the beginning of 2015 on behalf of the Federal Ministry of Education and Research (BMBF). In 2014, the turnover exceeded the milestone of 3 billion euros for the very first time. For the first time since 2008, spending on research and development (R&D) has increased once again.

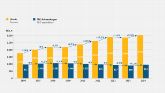

Development of turnover and R&D expenditure

In regards to turnover, 2014 was a record year – for the first time revenues surmounted the level of €3bn (2013: €2.86bn). Compared to the previous year, this means a plus of 5.8%. .The revenues recorded in the statistics derive from both the sale of products and services as well as from upfront and milestone payments through licensing agreements. Spending on research and development (R&D) showed a positive tendency. For the first time since 2008, spending on R&D projects was on the rise by 6.2% to €954m in 2014 (2013: €899m; 2012: €930m).

These positive developments were present throughout the different application fields of biotechnology. ‘Red’ biotechnology, which comes to a total of €2.08bn – two thirds of the total – continues to be the most important source of revenue. There was a clear increase of 7.1% compared to the previous year. Industrial biotechnology also recorded a growth. Here, the figures rose by 4% to €214m (2013: €206m). There was a similarly positive and ongoing development in the market for companies offering non-specific services (€676m, +2.3%) and bioinformatics applications (€36m). Bioinformatics specialists revenues rose by a remarkable 28%. Due to fewer companies active in the area of plant biotechnology, the revenue is further on the decrease: after €44m in 2012, the most recent figure came to just €30.5m.

Nevertheless, the economic significance of biotechnology is far greater than is suggested by the revenues at the dedicated companies. A much larger proportion of the revenue generated by biotechnological methods and techniques – such as biopharmaceuticals, diagnostics or reagents – derives from the 131 ‘other’ biotechnologically-active companies, and is not recognised in this survey. In the health sector in particular, biotech drugs are among the best-selling medicinal products, and large sums of money are already being generated by biotechnological products in the chemicals as well as and in other sectors, such as cosmetics.

The increase in R&D spending can largely be subscribed to medical biotechnology companies. At €773m euros, they contributed the bulk of R&D expenditure, an increase of 7.4 % compared to 2013 (€720m).

Like the previous year, an equally high R&D budget (2013: €48m) was put to use by companies active in industrial biotechnology (€47m). Similar developments were seen in the case of companies in the field of non-specific services – there R&D expenditure remained at €106m, as it did in 2013. In the area of plant biotechnology the declining trend can be seen: The companies only invested €15m in R&D, a smaller sum compared to the €16m invested in the previous year (-9 %).